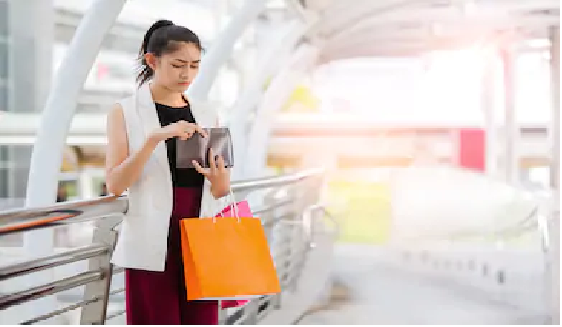

Shopaholism is common among young women. Increasing online shoppers, applications, and websites are proof that the trend of shopping is increasing day by day. Too much shopping means wasting time, money and energy which leaves you unsatisfied at the end. Many of the times, overspending impacts relationships and career badly. The question is, “can I overcome this addiction?” The answer is, “Yes,” you can. Keep in mind that things won’t change overnight, but the only solution is not to give up. The strategies will help you to make a barrier between you and your shopping addiction.

Here are some strategies

- Say “No” to credit cards: Shopping addicts should destroy their credit cards to avoid unnecessary expenses. They should keep themselves away until they overcome compulsive spending habits. Instead of carrying credit cards, you should bring cash whenever you go outside. It is because you want to overcome the addiction to excessive spending. It is because carrying cash reminds you of spending real money.

- No apps: If you are too addicted to shopping, remove shopping apps from your phones. Using online apps indulges you in spending more.

- Track your expenses: It is essential to know how much you are spending on your every habit. Keeping a record of the expenditure patterns helps you to take necessary actions against your spending addictions.

- Ask yourself: Ask yourself these simple questions to curb your shopping addiction for a particular situation.

1) Do I need this?

2) Where will I use it?

3) Do I have similar to this?

4) Can something be much better than this?

5) Can I wait to buy it?

6) What’s the purpose of buying it?

- Jotting down: Make a list of things that you wish to buy whenever you visit a store. Get back home and think again at least for ten days if you need that. If the answer is “Yes,” go ahead and buy it. If you are visiting a shopping website, you can add items to the bucket list and then think for a few days before spending.

- Know your future goals: Before spending on your bills, think if purchasing that will take you close or away from your next goal.

- Take help: Ask for advice from your friend or family member before buying something. Listen to them carefully and then decide if you still want to spend. Taking guidance for small decisions helps to break the cycle of impulsive spending.

Utpal Khot

Copyright © Utpal K

1. If you share this post, please give due credit to the author Utpal Khot

2. Please DO NOT PLAGIARIZE. Please DO NOT Cut/Copy/Paste this post

© Utpal K., all rights reserved.

Copyright Notice: No part of this Blog may be reproduced or utilized in any form or by any means, electronic or mechanical including photocopying or by any information storage and retrieval system, without permission in writing from the Blog Author Utpal Khot who holds the copyright